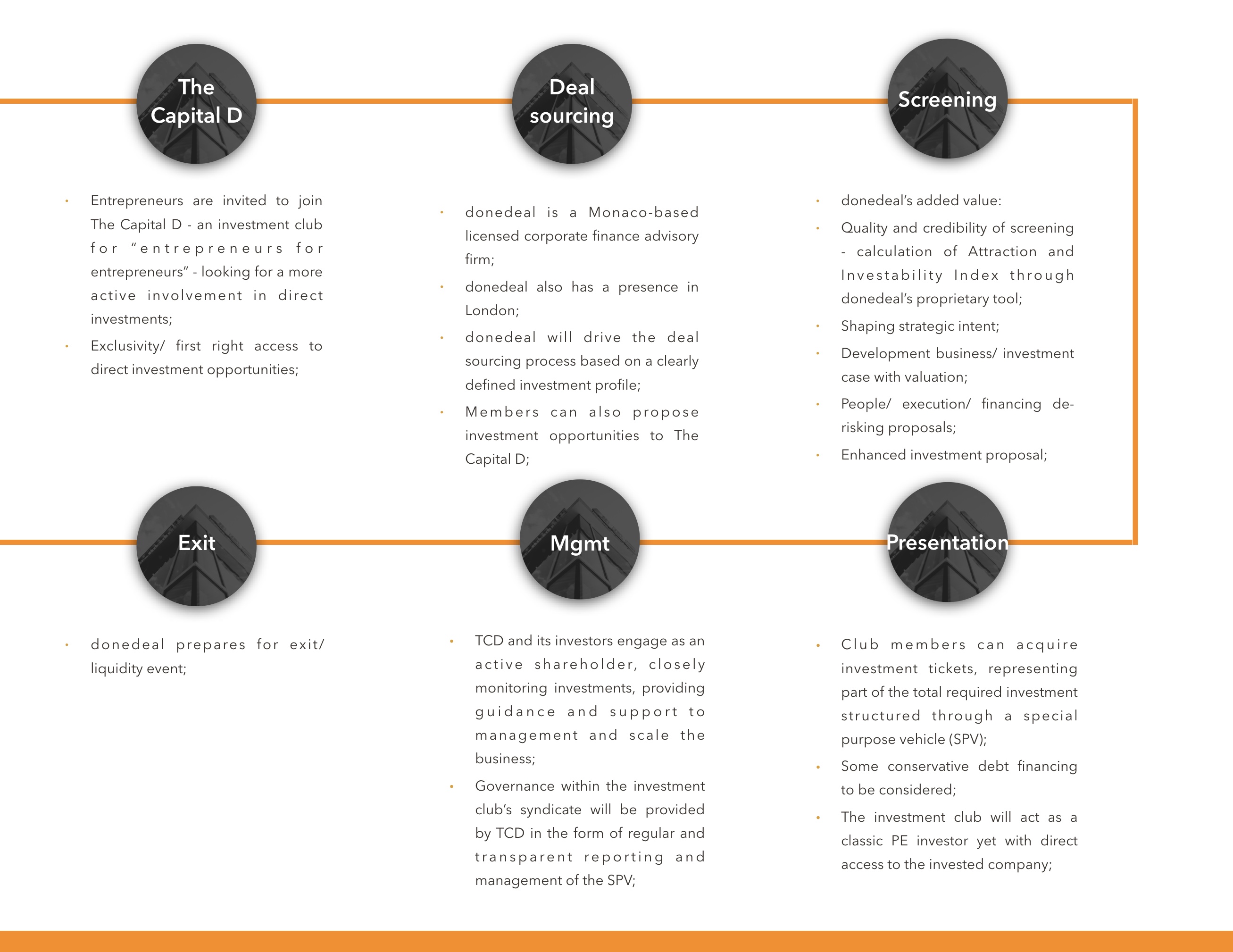

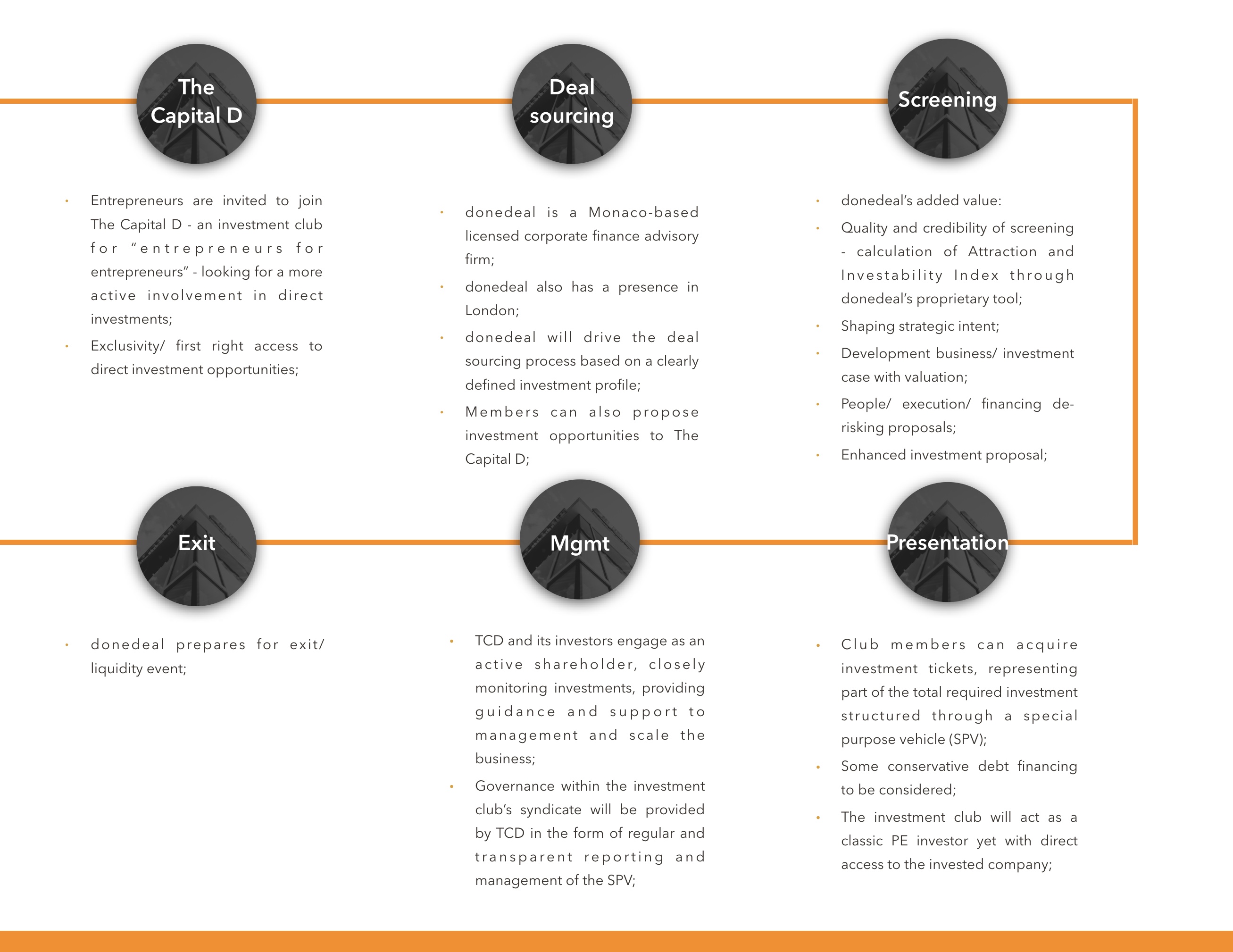

Donedeal’s entrepreneur investment club

- The Capital D is an independent investment club open to a selected group of entrepreneurs – “entrepreneurs for entrepreneurs” – looking for a more active involvement in direct investments;

- The Capital D members get exclusive or first right access to direct investment opportunities;

- Together with peers and donedeal partners, TCD members can add value to the growth of the investment through their sector/ product, service, market, lifecycle, strategy, and network expertise;

- The Capital D’s general investment profile includes:

- Smaller and medium sized companies across a variety of markets and sectors;

- Companies with a proven concept and sustainable business model;

- Disruptive companies, or companies focusing on overlooked, underdeveloped or ignored customers;

- Companies with a growth mindset through organic growth or buy-and-build;

- Companies who can achieve a boost through strategic changes and professionalisation;

- Companies with a positive social, environmental, cultural or governance impact;

- A clearly defined exit strategy